Davos 2026: The Trillion-Dollar Pivot

During the WEF’s Annual Meeting in Davos, Business for Nature and The B Team sat down with leaders from government, business, finance and civil society to confront the challenge of misaligned financial incentives. In partnership with InTent.

The Trillion-Dollar Pivot: Rewriting market signals for nature-positive growth

In a triple-COP year with intense global economic and geopolitical turbulence, the world cannot afford to keep paying for nature’s destruction. Today, at least USD 2.6 trillion in public spending is driving harmful outcomes. As businesses, communities and governments move closer towards nature-positive economies, they often run up against a wall of misaligned incentives.

During the WEF’s Annual Meeting in Davos, Business for Nature and The B Team, in partnership with InTent, hosted an event with leaders from government, business, finance and civil society to confront this challenge. This was a remarkable moment of renewed energy and determination to tackle incentives head-on and provided a call to action to leaders to continue the momentum on this issue in the run-up to the UN Biodiversity COP17.

Although the event brought together participants from vastly different sectors and geographies, there was clear consensus that to move from incremental change to transformation, we must execute The Trillion Dollar Pivot - a rewrite of the rules that can unlock the next wave of nature-positive investment and innovation.

“As long as public finance rewards environmental harm, nature-positive action will remain the exception, not the norm. Reforming financial incentives is a powerful and underused lever.”

As Leah Seligmann, Chief Change Catalyst & CEO of The B-Team, emphasized, transforming incentives is how we build the ‘rails’ for an economy in which every business, not just the leaders, can participate.

Why incentives are the missing lever

Participants agreed that even the most ambitious corporate climate and nature strategies cannot scale if markets continue to reward the wrong behaviours. In many sectors, it remains cheaper to degrade an ecosystem than to protect it. This distorts competition and penalizes businesses investing in resilience, circularity and regeneration.

But the tide is turning. New policy frameworks and financial instruments are emerging that can lower the cost of capital for nature-positive business models.

Jennifer Morris, CEO of The Nature Conservancy, highlighted that the finance sector is beginning to provide “bankable, low-interest initiatives”. A prime example is Brazil’s 1% interest rate model for farmers, which makes the regenerative transition affordable.

Discussions surfaced the message that progress will remain incremental unless the enabling environment - the rules, subsidies, taxes and financial structures - reorient toward outcomes that benefit nature, climate and people.

As the CEO of Virgin Unite, Jean Oelwang so eloquently summarized: “Everyone says it’s too hard, but we can do it. After all, we created it.”

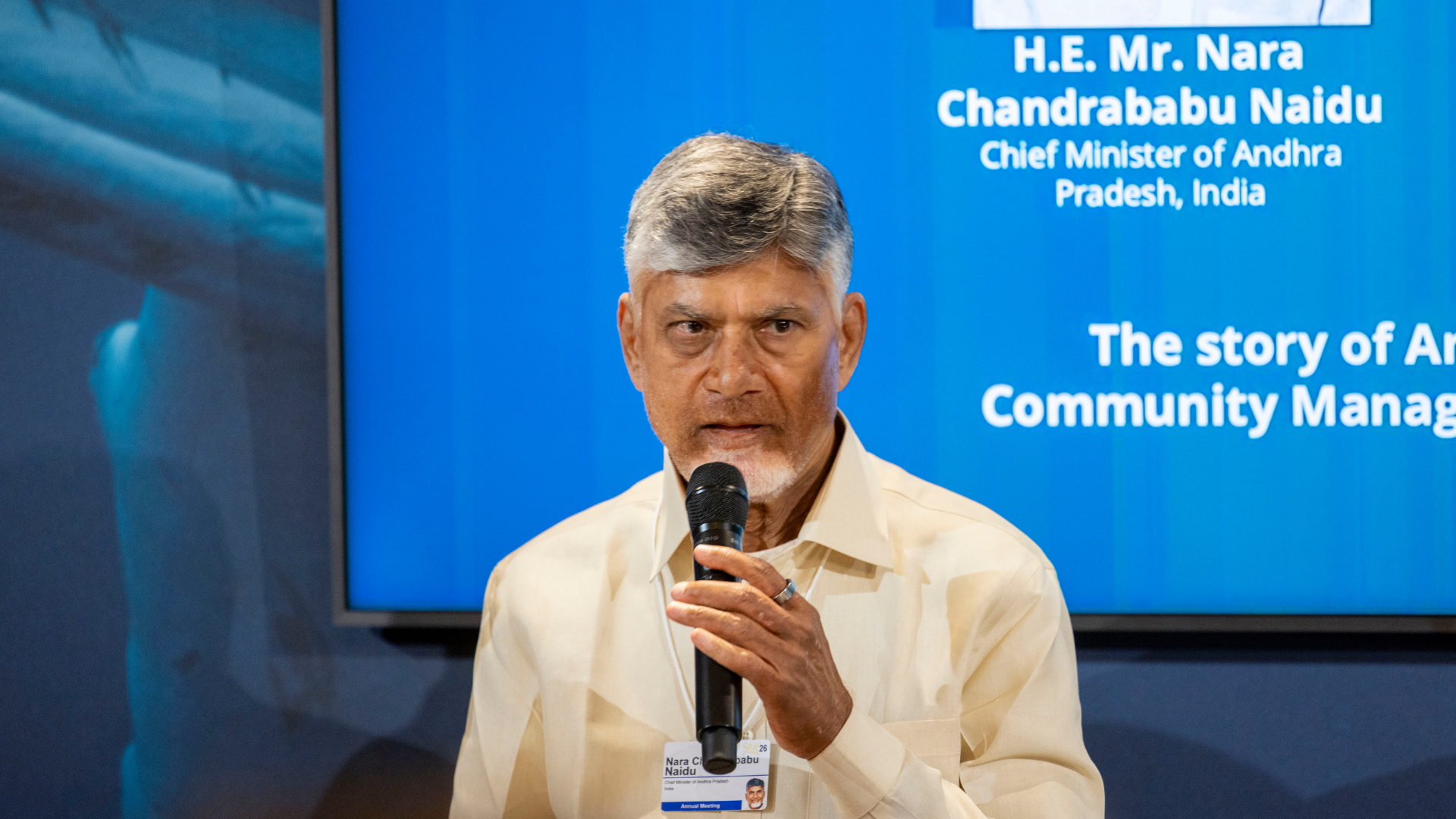

Leadership in action: Andhra Pradesh and beyond

The pivot is already happening on the ground. Chief Minister N. Chandrababu Naidu and Satya S. Tripathi (GASP) shared how India’s Andhra Pradesh Community-managed Natural Farming initiative has scaled to 1.8 million farmers.

By replacing expensive chemical subsidies with long-term capacity-building on natural farming, the program has seen net farmer income increase by 49% to 80%. This isn't just an environmental win; it’s a de-risking strategy. Health outcomes have improved as communities reduce exposure to chemical pesticides. Employment opportunities have grown, particularly for women. And by investing in long-term soil fertility rather than short-term synthetic inputs, farmers are reducing vulnerability to water stress and climate extremes.

What incentives mean for CEOs and policymakers:

To move the needle, we must address the influence and impact the current rules exert. For CEOs and boardrooms, the challenge is an artificial – yet often hidden – competitive disadvantage, where doing the right thing currently costs more. Business leaders must ask governments to put in place the incentives that ensure nature-positive action becomes the fiduciary choice, ensuring that the most profitable path for a company is the one that is also within planetary boundaries.

We are already seeing the risk of backtracking; for example, the removal of tax incentives for the Brazil Soy Moratorium has prompted major traders to reconsider their environmental commitments, proving that without firm rails, corporate intentions can stall.

For governments, the priority is to create stable, long-term market signals. Several participants at the Davos event highlighted that when incentives are properly aligned, through fair carbon pricing, water rules or affordable finance, sustainability and profitability reinforce each other. And they work! Examples were cited where this is already happening, the elephant in the room being the early incentives for renewable energy, including solar, that feel today like simple market competitiveness but wouldn’t have happened without early government support. Or in Costa Rica, a fossil fuel tax channelled revenues into ecosystem restoration, driving a dramatic increase in forest cover.

Policymakers are beginning to show what good looks like. The Netherlands' approach to mapping and tracking the flow of incentives – including their impact on biodiversity - was highlighted as a model that builds trust and provides long-term certainty. Participants also stressed that businesses cannot invest confidently if incentives are reversed without warning or if tracking systems are weak.

Imagining 2040: what must change now

In breakout sessions, leaders worked backward from a 2040 vision where incentives are the norm that mean ecosystems are managed sustainably. To get there, some priorities emerged:

Keep people at the center: Subsidies were put in place for socio-economic reasons, which must be fully recognized. Any shift needs to be carefully planned to make sure people, often farmers, are brought along with the necessary change and are supported as they manage any direct risks, including financial.

Break the winners and losers myth: While shifting subsidies might cause friction, we must move beyond the binary of winners and losers. As one participant noted, we can accept a world where some are ‘slightly less happy’ if it means the global population is significantly better off.

Reframe the debate: leaders in the room argued that reframing the debates around ‘collective gain’ vs ‘loss’ would help, and that incentives is an inherently positive agenda to work together on.

Align trade rules: International markets must reward products and practices that regenerate nature, not those that undercut prices through environmental damage.

Prioritize a just transition: Reforming subsidies will reshape labour markets; proactive reskilling and job creation are essential to avoid deepening inequality.

Coordinate across sectors: Participants noted that governments, NGOs, financial institutions and businesses are tackling subsidy reform in parallel but not in partnership. Greater alignment is essential to accelerate change

The overarching outcome was clear: we cannot subsidize our way to a crisis and then donate our way out of it. The Trillion‑Dollar Pivot is about designing economies where the most profitable path for any business is the one that restores climate and nature - because the rules make it so.

This is why reforming incentives is now a priority for Business for Nature, The B Team and many of our partners as we head toward COP17 and beyond.

Governments agreed years ago to shift harmful subsidies and redirect public finance toward solutions, but progress has been far too slow. As of late 2025, only a small handful of countries had set meaningful national goals to review and reform their incentive systems, while more than half had taken no meaningful steps at all. This gap poses a major risk: without clear, supportive rules, even the most ambitious businesses will struggle to invest with confidence. But if governments act now, they can unlock billions in private investment, level the playing field and accelerate the transition to a nature‑positive, resilient global economy.

Reforming incentives is not too good to be true – it’s a no-brainer.

A huge thanks to all our speakers and moderators:

Chandrababu Naidu Nara, Chief Minister of Andhra Pradesh, Government of Andhra Pradesh

André Hoffmann, Co-Chair World Economic Forum, Vice-Chair of Roche Holding

Ilham Kadri, Special Advisor to Syensqo and Temasek, Chair of WBCSD

Mats Granryd, Chair of the Board, Vattenfall

Adrien Geiger, CEO, L’Occitane en Provence

Paul Polman, Founder IMAGINE and B Team Leader

Jean Oelwang, CEO, Virgin Unite (moderator)

Patricia Zurita, Chief Partnerships Officer, Conservation International

Stientje van Veldhoven, Vice President and Regional Director for Europe (ex Environment Minister for Netherlands), WRI

Hindou Oumarou Ibrahim, Vice President, UNPFII

Carmen Díaz Canabal, CSO, Holcim

Sunya Norman, SVP of Impact, Salesforce

Jaime de Bourbon de Parme, Director of Environment, OECD

Jacqueline Novogratz , CEO, Acumen

Erin Billman, CEO, Science Based Targets Network (SBTN)

Marco Lambertini, Convener, Nature Positive Initiative

Eliot Whittington, Chief Systems Change Officer, CISL

Emeline Fellus, Senior Director, Agriculture & Food, WBCSD

Robin Hodess, CEO, Global Reporting Initiative (GRI)

Sherry Madera, CEO, CDP

Tony Goldner, CEO, Taskforce on Nature-related Financial Disclosures (TNFD)